- Paying employees in India requires either establishing a local entity or partnering with an Employer of Record, then registering for PAN, TAN, EPF, and ESI with Indian tax authorities.

- You must calculate and deduct 12 percent Employee Provident Fund contributions, income tax through TDS, ESI contributions, and state professional tax from each employee's gross salary.

- Indian salaries follow a Cost-to-Company structure with basic pay at 40 to 50 percent, house rent allowance, special allowances, bonuses, and employer-paid provident fund contributions.

- Pay employees monthly in Indian Rupees by the 7th of the following month through direct bank transfer with detailed payslips showing all earnings and deductions.

- Maintain payroll records, file monthly EPF and ESI returns, provide statutory leave benefits including 15 days annual leave and maternity leave, and ensure data protection compliance.

Need help paying employees in India? Contact our team today!

Discover how Wisemonk creates impactful and reliable content.

How do you pay employees in India compliantly? The payroll process in India involves navigating state-specific labor laws, mandatory deductions like EPF and ESI, and strict payment deadlines. For US and foreign companies, understanding salary structures, tax withholdings, and compliance requirements is essential. This guide walks you through salary calculations, tax deductions, payment processing, and ongoing compliance requirements.

How do you determine the correct wage in India?[toc=Determine the Correct Wage]

When you look to hire & pay employees in India, a common mistake is thinking there's a single, nationwide minimum wage. The reality is far more complex, with rules varying significantly by state and even by industry.

Understanding the Minimum Wage Puzzle

Determining the correct wage is the first critical step when you decide to pay employees in India. Unlike a uniform national minimum wage, the minimum wage for employees in India is set at the state level. This means what's compliant for a remote employee in one state might not be for a factory worker in another.

We've seen global companies get tripped up by this, as the variations are considerable based on factors like the specific industry, job function, and the worker's skill level, be it unskilled, semi-skilled, or skilled. Navigating these local regulations is essential to avoid compliance risks and is a key part of setting a fair employee's basic salary.

The 48-Hour Workweek and Overtime

Beyond the minimum wage, India's employment laws strictly regulate working hours. The standard workweek is 48 hours. Any time an employee works beyond this, they are legally entitled to overtime pay. Our experience shows that clear communication about working hours and overtime payment in the employment contract is vital. Indian labor laws mandate that overtime pay must be at least twice the regular rate, a detail that many foreign businesses overlook.

By carefully structuring an employment agreement and adhering to these rules, you not only protect your company but also build trust with your team. This focus on compliance is a cornerstone of responsible global employment.

What registrations are needed for tax and social security?[toc=What Registrations Needed]

Setting up a payroll system in India requires specific registrations with the Indian government to ensure legal compliance. Failing to secure these can expose your business to significant compliance risks.

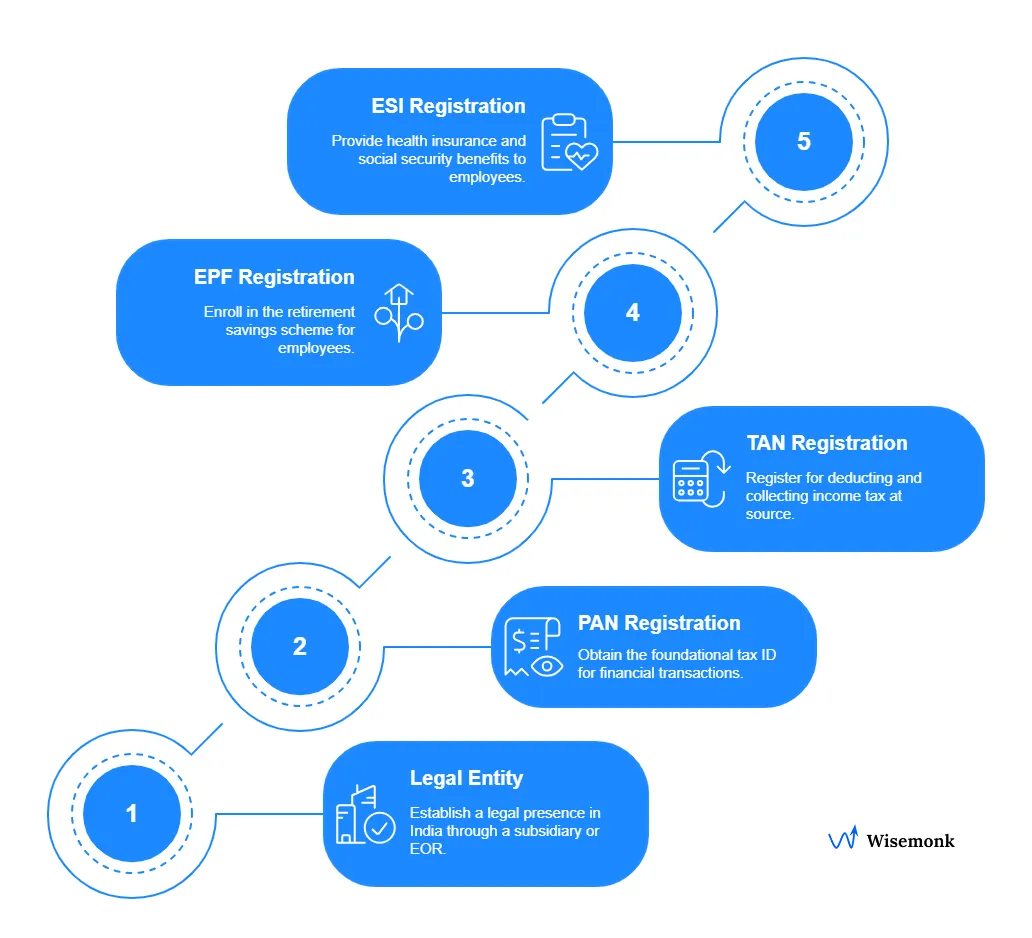

Onboarding Step: Legal Entity or Employer of Record (EOR)

Before even applying for PAN, TAN, EPF, or ESI, foreign companies must ensure they have the right presence in India. You cannot directly employ and pay staff in India without either (a) setting up a legal entity such as a subsidiary, or (b) partnering with an Employer of Record (EOR) that already has the necessary registrations and can hire employees on your behalf. This step is essential for compliance and is often the first hurdle global businesses face.

Based on our experience, once this foundation is in place, the next critical step is obtaining the necessary tax and social security numbers:

1. PAN: The Permanent Account Number

The Permanent Account Number (PAN) is a ten-digit alphanumeric identifier issued by the Income Tax Department. Think of it as the foundational tax ID for your business in India. Every legal entity, be it a local subsidiary or a foreign company with a permanent establishment, must have a PAN to conduct financial transactions and, most importantly, for all tax-related matters, including paying an employee's basic salary.

2. TAN: The Tax Deduction and Collection Account Number

The Tax Deduction and Collection Account Number (TAN) is a mandatory registration for any entity that needs to deduct income tax at source. This is vital because as an employer, you are legally required to deduct withholding income tax from your employees in India before paying them.

The TAN is used to deposit these taxes with the Indian government and file the TDS (Tax Deducted at Source) returns. Without a TAN, you can't properly manage your payroll deductions and will face penalties.

3. EPF: The Employees' Provident Fund

The Employees' Provident Fund (EPF) is a retirement savings scheme and is a key component of social security. It is mandatory for any establishment with 20 or more Indian workers. The employer and the employee's basic salary are both subject to a mandatory contribution towards the provident fund.

This is one of the most significant aspects of payroll and Indian labor laws, and it’s a non-negotiable part of the employment relationship for most workers. The employees pension scheme is a crucial part of this fund, providing long-term financial security.

4. ESI: The Employee State Insurance

For businesses with 10 or more employees in India earning up to a specific wage limit, registration with the Employee State Insurance (ESI) Corporation is required. This scheme provides health insurance and other social security benefits to employees and their family members. The ESI contribution, like EPF, is a shared responsibility between the employer and employee.

This is a crucial element of comprehensive benefits administration and highlights the country's commitment to worker welfare. We've found that getting these registrations right from the start is paramount for any legal entity looking to establish a compliant and trusted presence in India.

How do you calculate and deduct payroll taxes and contributions?[toc=Calculate & Deduct Payroll Taxes]

Once you have the necessary registrations, the next step is the actual calculation and deduction of payroll taxes. This is where many foreign companies find themselves navigating a new set of rules, as the responsibility for these deductions rests squarely with the employer.

For any legal entity in India, accurate and timely deductions are not just a best practice; they are a legal requirement under various labor laws.

1. TDS (Tax Deducted at Source)

TDS is essentially withholding income tax on salaries. As the employer, you must calculate and deduct this tax from each indian employee's salary every month. The amount of income tax to be deducted depends on the employee's total annual income, which includes their basic salary, allowances like house rent allowance (HRA), and other benefits. You must account for any tax-saving investments declared by the employee to arrive at the net taxable income.

Our work with global employment has shown that for remote employees, this calculation can be complex, as their salary structure might be different from traditional employees. We help foreign businesses ensure these calculations are precise to avoid future audits and penalties.

2. EPF (Employees' Provident Fund) Contributions

The provident fund is a cornerstone of social security for employees in India. Both the employer and the employee contribute a mandatory 12% of the employee's basic salary (and a few other allowances, if applicable) to this fund. The employer's contribution is further split between the Employees' Provident Fund (3.67%) and the Employees' Pension Scheme (8.33%).

It's crucial to understand that the employer's portion is an additional cost on top of the employee's gross salary. These contributions must be remitted monthly to the Employees' Provident Fund Organisation (EPFO).

3. ESI (Employee State Insurance) Deductions

If your business has 10 or more employees in India with a salary below a specific limit, ESI deductions are mandatory. This provides health insurance and other benefits. The Employee State Insurance contribution is also a shared responsibility.

A small percentage is deducted from the employee's wages, while the employer contributes a higher percentage. The exact percentage rates are set by the central government and are subject to change, so staying updated is key to avoiding compliance risks.

4. Professional Tax

Finally, there's the professional tax. This is a state-level tax, so it’s not applicable everywhere, but where it is, it's a mandatory monthly deduction. The amount is usually a small fixed sum and is based on salary slabs. For example, a company with employees in India's states of Karnataka or Maharashtra will have to deduct this tax, whereas a company with remote employees in Delhi will not.

As with all other payroll deductions, the employer is responsible for deducting the tax and remitting it to the respective state government. This is a perfect example of how granular India payroll can be, requiring attention to local laws and regulations.

How should payroll be processed and payments made?[toc=Payroll & Payment Processing]

After calculating all the necessary taxes and contributions, the final and most visible step for your employees in India is getting paid. This process has its own set of rules and best practices that are crucial for any global employment operation.

1. Payroll Frequency & Compliance Risks of Delays

In India, the most common payroll frequency is monthly. While some industries might use weekly or bi-weekly cycles for hourly or unskilled workers, paying salaried staff once a month is the standard. Importantly, Indian labor laws require that salaries be paid by a specific deadline, usually before the 7th of the following month. Missing this deadline can result in labor disputes, fines, or reputational damage. A predictable monthly cycle tied to a fixed date helps ensure compliance and employee trust.

2. Salary Currency and Payment Method

Under Indian law, specifically the Foreign Exchange Management Act (FEMA), all salaries to resident employees in India must be paid in Indian Rupees (INR). You cannot legally pay employees their monthly salary in a foreign currency like USD or GBP, even if the employment contract is denominated in that currency. The amount must be converted and disbursed in INR.

The most common and secure payment method is a direct bank transfer. The Unified Payments Interface (UPI) and other electronic funds transfer systems have made this process seamless. We always recommend that international employees working in India have a local bank account to receive their salary directly.

3. Contractors vs. Employees: Different Rules

While employees must be paid in INR, companies often engage freelancers or independent contractors. Unlike employees, contractors can be paid in foreign currency (e.g., via international wire transfer or global payment platforms), as their arrangement falls outside the scope of local payroll rules.

However, companies must carefully classify workers correctly, since treating employees as contractors to bypass payroll compliance carries significant legal risks.

4. The Importance of the Payslip

A detailed payslip is more than just a summary of a salary, it's a legal document. Every payment of an employee's salary must be accompanied by a comprehensive payslip that clearly breaks down all earnings (like basic salary, allowances, and bonuses) and all payroll deductions (TDS, provident fund, etc.). This is a mandatory statutory requirement and is essential for both your internal record-keeping and for the employee's own tax filing.

For foreign employers, navigating this complex process can be challenging. Many choose to partner with local payroll service providers or use best payroll software for India to ensure compliance and accuracy in their Indian payroll operations.

Why is proper payroll record-keeping important?[toc=Importance of Payroll]

Maintaining accurate payroll records in India is a legal requirement under the Payment of Wages Act, Minimum Wages Act, and Employees' Provident Fund Act. Employers must preserve wage registers, attendance records, tax deductions, and statutory contribution documents for three to five years depending on the specific regulation. Government audits by EPFO, ESIC, and Income Tax authorities require immediate access to these records, and failure to produce them results in penalties up to INR 50,000 per violation.

Here's what you need to know to stay compliant and avoid penalties:

- Mandatory Retention Periods: Preserve wage registers and attendance records for three years under the Payment of Wages Act, while EPF and ESI contribution records must be retained for five years from the last entry date.

- Essential Documentation Requirements: Maintain employee PAN numbers, bank details, complete salary breakdowns, attendance records, and all statutory deduction proofs including EPF at 12 percent, ESI payments, TDS amounts, and professional tax.

- Audit Compliance and Penalties: Government audits verify EPF deposits by the 15th of each month and timely TDS filings, with penalties ranging from INR 10,000 to INR 50,000 per violation for missing records.

- Transparent Payslip Requirements: Issue detailed monthly payslips by the 7th showing all earnings, statutory deductions including EPF and TDS, and net take-home pay to reduce disputes and build employee trust.

- Data Protection Compliance: India's Digital Personal Data Protection Act of 2023 mandates encrypted storage with role-based access controls and Indian server data localization, with penalties up to INR 250 crore for breaches.

What other factors should global companies keep in mind?[toc=Factors to Consider]

Beyond the fundamental payroll mechanics, there are several other critical aspects of global employment that foreign companies must be aware of to ensure compliance and mitigate compliance risks.

1. Salary Structure & Allowances

The take-home employee's salary in India is rarely just a basic salary. It's a complex structure with various components and allowances that have different tax implications.

- House Rent Allowance (HRA): A common allowance for employees renting a home, which is partially or fully exempt from income tax.

- Conveyance Allowance: An allowance for commuting expenses, which is also tax-exempt up to a certain limit.

- Variable Dearness Allowance (VDA): A periodic adjustment to the minimum wage to offset inflation. This is a key detail that can be missed by those unfamiliar with India's employment laws.

- Other allowances: This can include medical allowances, education allowances, and more, all of which must be correctly factored into the total compensation.

Curious about how your CTC translates to in-hand pay? Try our Salary Breakdown Calculator for a quick, personalized estimate!

2. Gratuity & Leave Obligations

You must also consider end-of-service benefits and employee leave.

- Gratuity: This is a mandatory lump-sum payment given to an Indian employee as a token of appreciation for long-term service. An employee becomes eligible after completing at least up to five years of continuous service with the same company. This is a legal obligation under the Payment of Gratuity Act and is a significant cost to factor into your long-term budget.

- Paid Leave: Indian labor laws also mandate entitlements like paid annual leave and sick leave. The number of days can vary by state and industry. For instance, sick leave is typically a statutory benefit that must be provided. For pregnant employees, maternity leave is another critical, legally mandated benefit.

3. Employee vs. Contractor Classification

Misclassifying a worker as an independent contractor is a major source of legal and financial risk for foreign businesses.

- Control Test: Indian courts often use this test to determine the true nature of the employment relationship. If your company dictates not just the result of the work, but also how and when the remote workers perform their job duties, it is likely an employer-employee relationship, not an independent one.

- Consequences of Misclassification: The penalties for getting this wrong can be severe, including back payment of taxes and social security contributions like provident fund and ESI, as well as fines. It's crucial to understand the distinction before you hire contractors.

Avoid costly mistakes, read our full guide on Contractors vs. Employees in 2025.

4. Foreign Exchange & Data Protection

The way you handle money and data is also heavily regulated.

- FEMA Compliance: Under the Foreign Exchange Management Act (FEMA), all payments to a resident employees in India must be in Indian Rupees (INR). You cannot directly remit salary from a foreign currency account abroad to their personal account in USD, for example. Even if you don’t have a legal entity in India and pay through a service, the final payment to the employee must be in INR.

- Data Protection: India’s Digital Personal Data Protection Act of 2023 mandates that global companies must handle sensitive employee information, like payroll records, with stringent security and consent protocols. Protecting this data isn’t just good practice; it’s a legal requirement that carries significant penalties for non-compliance.

Why Choose Wisemonk for your payroll operations in India?[toc=Why Choose Wisemonk]

Wisemonk is a leading Employer of Record helping companies pay employees in India compliantly without establishing a local entity. We handle complex payroll calculations, statutory compliance, and benefits administration so you can focus on building your team and growing your business in India.

Key Services for Simplified Payroll & Compliance:

- End-to-End Payroll Management: We process payroll for 300+ global companies with 100% accuracy, managing everything from EPF and ESI contributions to TDS calculations and remittance by the 15th of each month, with the industry's lowest FX markup at less than 0.6 percent compared to competitors charging up to 10 percent.

- Industry's Lowest FX Rates: Pay employees in INR with just 0.6% FX markup versus 5-10% competitors charge, saving thousands monthly. We disburse salaries and handle expense reimbursements and bonuses at no extra cost through NEFT, RTGS, and UPI.

- Tax-Optimized Salary Structuring: Our experts design salary components that increase employee take-home pay by 15-20% while maintaining full compliance. We manage provident fund, health insurance, and pension contributions to keep you competitive in India's talent market.

- Rapid Compliant Onboarding: We onboard employees in just 2 days, 3-5x faster than global EOR providers, handling employment agreements, background verification, PAN and TAN registration, and all documentation while ensuring compliance with Indian labor laws across all 28 states.

- Dedicated Indian HR Experts: Get 24/7 support from our expert HR team rated 4.9/5 stars by 150+ verified users on G2, Capterra, and Clutch. We handle leave policies, terminations, and employee relations so you stay compliant and conflict-free.

Beyond payroll, we can also help you with recruitment, contractor management, and onboarding in India. Whether you need to hire employees in India, pay freelancers, or build a compliant offshore team, we’ve got you covered with transparent pricing and deep local expertise. If you’re looking to expand further, we offer services like background verification, benefits administration, company registration and even support for setting up a Global Capability Center, making Wisemonk your one-stop partner for all things workforce in India!

Ready to hire & pay employees in India effortlessly? Contact us today and let’s get started.

.webp)

%20(3).webp)