Trusted by 500+ Global Companies

Everything you need to successfully build your team in India

End-to-end Platform

Robust employment and tax law compliance

.webp)

India based dedicated HR expertise

.webp)

WHY CHOOSE US?

Personalizable Employee Benefits

Higher Take-Home Pay

India-Based Dedicated HRBP

Our Core Focus

Great Employee Experience

Integrations

Seamless integration with your workflow and processes

What our customers say

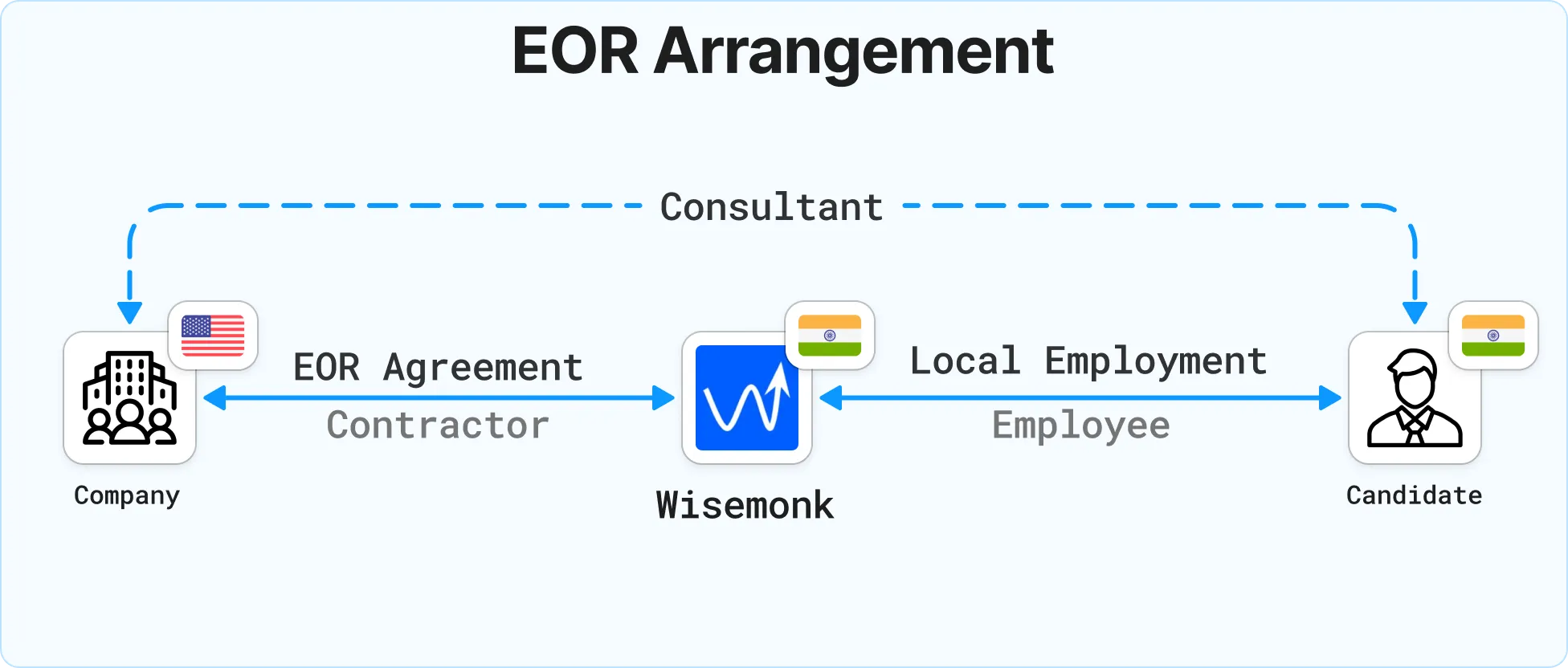

What is an EOR in India?[toc=What is an EOR]

An Employer of Record (EOR) in India is a third-party service provider that legally employs workers on behalf of global companies. The EOR manages hiring, employee contracts, payroll, compliance with Indian labor laws, and statutory benefits like Provident Fund (PF) and Employee State Insurance (ESI). This allows businesses to hire employees in India without establishing a local entity, ensuring full legal compliance and minimizing administrative burden.

How an EOR works in India?[toc=How EOR Works in India]

An Employer of Record (EOR) in India helps foreign companies hire and manage employees in compliance with local labor laws without needing to set up a local entity.

Here’s a breakdown of how an EOR in India works:

1. Hiring and Employment Contracts

An EOR handles all aspects of hiring in India, ensuring compliance with Indian labor laws.

This includes:

- Drafting and managing employment contracts: The EOR ensures that contracts are aligned with local employment regulations such as the Indian Contract Act and Minimum Wages Act.

- Legally employing workers: While your company remains in charge of day-to-day employee tasks, the EOR becomes the legal employer.

Click here to learn more: Remote Hiring in India: Independent Contractor vs EOR Employee Explained.

2. Onboarding and Employee Benefits

Once employees are hired, the EOR manages the entire onboarding process, ensuring a smooth transition for both the employee and the company:

- Background checks and documentation: The EOR handles all compliance checks, documentation, and employee registration with relevant authorities.

- Statutory benefits administration: The EOR ensures employees receive statutory benefits, such as:

- Provident Fund (EPF)

- Employee State Insurance (ESI)

- Health insurance

- Retirement benefits and paid leave

Click here to learn more: Detailed Onboarding Checklist for Remote Employees in India

3. Payroll and Tax Management

The EOR ensures that all payroll-related processes are handled accurately and in compliance with Indian tax laws:

- Salary disbursement: The EOR manages the payroll processing and ensures employees are paid on time.

- Tax withholding and compliance: The EOR calculates and withholds TDS (Tax Deducted at Source), ensuring compliance with the Income Tax Act and Goods and Services Tax (GST) regulations.

- Statutory deductions: The EOR handles statutory deductions such as Professional Tax and Provident Fund (PF).

4. Compliance with Indian Labor Laws

Indian labor laws can be complex, and an EOR helps mitigate risks by ensuring compliance:

- Adherence to local laws: The EOR keeps your business compliant with all relevant laws, including the Industrial Disputes Act and Code on Wages.

- Minimum wage regulations: The EOR ensures employees receive at least the minimum wage as per Indian labor laws, avoiding legal disputes.

- Legal updates: The EOR stays updated with changes in local labor laws, ensuring your business is always in compliance.

5. Managing Employee Terminations

If an employee needs to be terminated, the EOR ensures the process is compliant with Indian labor laws:

- Termination procedures: The EOR follows the legal process for termination, including handling severance pay and issuing termination letters.

- Dispute resolution: The EOR helps manage potential disputes, ensuring compliance with the Industrial Disputes Act.

6. Ongoing HR and Administrative Support

The EOR takes care of various HR tasks, enabling you to focus on your core business:

- Leave management: The EOR handles employee leave records and statutory entitlements.

- Employee performance management: The EOR assists with performance tracking and ensures employees receive appropriate support.

- Benefits administration: The EOR ensures all employee benefits (like health insurance and paid leave) are managed effectively.

7. Legal Compliance and Risk Mitigation

An EOR in India helps reduce the risk of legal complications:

- Tax filings and remittances: The EOR manages all tax filings and remittances to government authorities, ensuring timely and accurate submissions.

- Compliance with labor regulations: The EOR acts as the legal employer, ensuring your business avoids potential legal issues related to employment.

8. Tax and Regulatory Reporting

The EOR takes care of tax and regulatory reporting to ensure full compliance:

- Tax reporting: The EOR handles all necessary tax filings, including TDS and income tax, ensuring your business stays audit-ready.

- Recordkeeping: The EOR maintains detailed records of all payroll transactions, deductions, and tax filings.

Partnering with an EOR in India helps businesses navigate the complexities of local labor laws, ensure compliance, and mitigate risks without the need to set up a local entity. The EOR manages the heavy lifting of payroll, employee benefits, and legal compliance, allowing you to focus on growing your business.

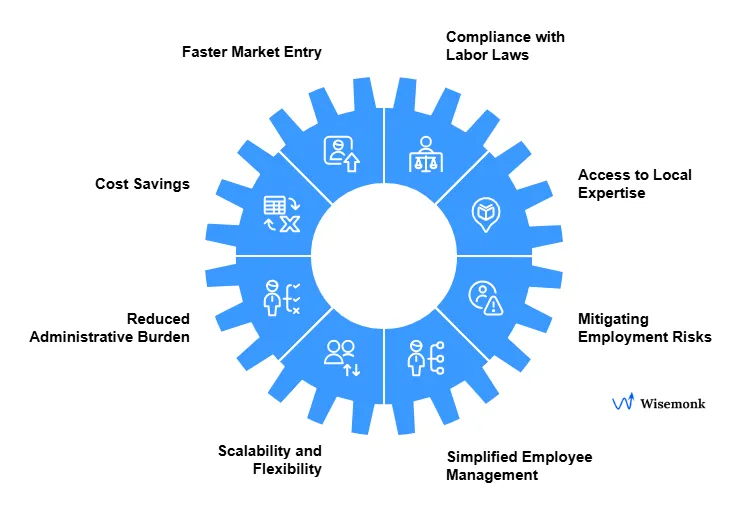

Why do global companies use EORs in India?[toc=Benefits of EOR]

Global companies increasingly turn to Employer of Record (EOR) services in India to streamline their hiring process, ensure compliance with local laws, and avoid the complexities of setting up a local entity.

Based on our extensive research and client feedback, here are the key benefits of using EOR services in India:

1. Faster Market Entry

Setting up a legal entity in India can be time-consuming and complex. EORs enable companies to hire employees and start operations in India almost immediately. With the EOR handling all the legal formalities and compliance, businesses can quickly scale without the delays associated with establishing a local presence.

Ultimately, the choice depends on the company's resources, timeline, and risk tolerance. Click here to learn more: Employer of Record vs Own Entity: Choose the Right Global Hiring Strategy

2. Compliance with Complex Indian Labor Laws

India has a vast and intricate legal framework for employment, including the Indian Contract Act, Minimum Wages Act, Provident Fund regulations, and more. The EOR ensures compliance with these laws, significantly reducing the risk of legal disputes and penalties related to non-compliance.

3. Cost Savings

Setting up a local entity in India comes with significant overhead costs, such as office space, local legal teams, and HR staff. By partnering with an EOR, global companies can avoid these costs and save on administrative overhead. This cost-effective solution allows businesses to allocate resources more efficiently, especially during the early stages of expansion.

4. Access to Local Expertise

EORs bring deep knowledge of local employment practices, tax regulations, and benefits administration in India. This local expertise ensures that global companies can navigate India's business culture, regulatory environment, and market conditions smoothly and effectively. The EOR becomes a trusted partner in making informed decisions about hiring and employee management.

5. Reduced Administrative Burden

By outsourcing HR tasks like payroll management, employee onboarding, and benefits administration, companies can focus on their core business activities. The EOR handles the complexity of managing payroll taxes, employee benefits, and statutory requirements, allowing businesses to save time and reduce the administrative workload.

6. Mitigating Employment Risks

Global companies, especially those new to India, may struggle with local labor law compliance. An EOR mitigates these risks by taking on the legal responsibilities of being the legal employer. This protects your business from costly mistakes like improper terminations, misclassification of contractors, or incorrect tax filings.

7. Scalability and Flexibility

EOR services offer flexibility, allowing companies to scale up or scale down their workforce easily based on project needs or business expansion plans. Whether hiring full-time employees, contractors, or temporary staff, the EOR allows global companies to adjust their workforce without the administrative complexity of hiring in a foreign market.

8. Simplified Employee Management

With an EOR, employee management becomes much easier, as the EOR handles all HR-related tasks, including leave management, performance tracking, and termination processes. This simplifies the workflow for international companies, as they don’t need to worry about navigating local labor laws or managing employee records.

Global companies use EORs in India to simplify the complexities of international hiring, minimize administrative burdens, and ensure compliance with Indian labor laws. With an EOR handling critical HR and legal tasks, businesses can focus on their core goals, expand faster, and reduce the risks associated with entering a new market.

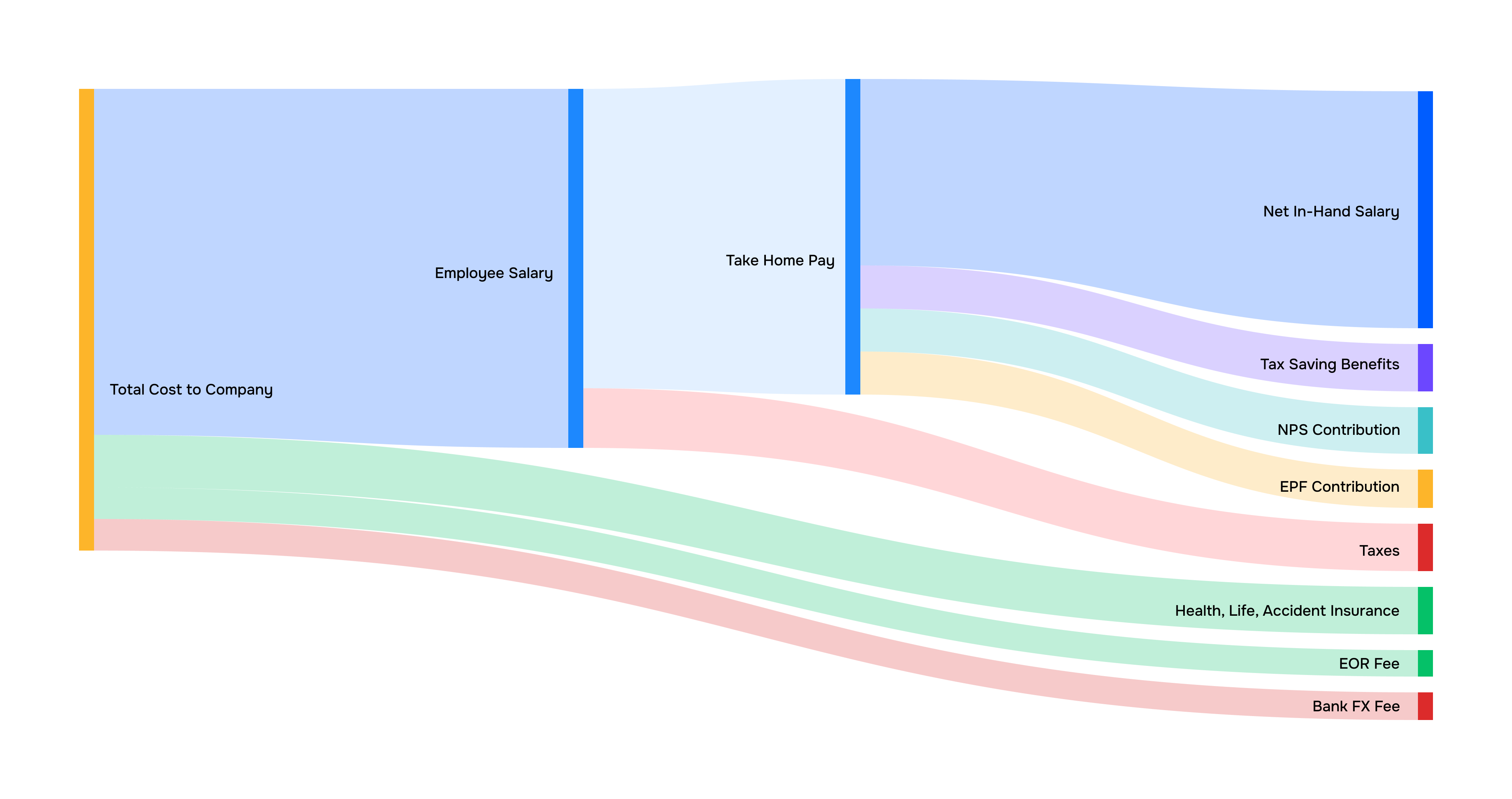

What are the key aspects of payroll in India?[toc=Payroll in India]

Managing payroll in India is a critical responsibility for any employer and, in our experience supporting global teams, we have found that Indian payroll is uniquely complex due to frequent regulatory updates and strict local compliance requirements. An Employer of Record (EOR) in India takes over this burden, ensuring every aspect is handled accurately and on time.

1. Statutory Deductions and Contributions

- Provident Fund (EPF): Both employer and employee must contribute to the Employees’ Provident Fund, a mandatory retirement savings scheme.

- Employee State Insurance (ESI): Required for employees earning below a specific threshold, covers medical and disability benefits.

- Professional Tax: Levied by some states, deducted from the employee's salary each month.

- Tax Deducted at Source (TDS): Income tax withheld from salaries as per individual tax slabs and deposited with the government.

2. Payroll Compliance

- Payroll must be compliant with all applicable regulations, such as the Payment of Wages Act and Minimum Wages Act.

- Accurate calculation and timely international payment of wages, overtime, bonuses, and leave encashment are essential to avoid legal risk.

3. Payroll Processing and Disbursement

- Wages are typically processed on a monthly basis.

- Payslips detailing gross salary, deductions, and net pay must be provided to employees.

- All statutory contributions and taxes must be deposited with respective government authorities within specified deadlines.

4. Reporting and Recordkeeping

- Employers must maintain detailed payroll records, including salary structure, attendance, statutory contributions, and tax filings, generally for at least three years.

Payroll elements can differ by state, such as professional tax rates, leave policies, and wage structures, so expertise in local, as well as national, rules is vital.

Cost-to-Company Calculator for Hiring Employees in India[toc=CTC Calculator]

Looking to hire employees in India but unsure about the total cost?

Our fully loaded cost calculator makes it easy for you to estimate your expenses. Simply enter the gross salary of your potential employee, and our calculator will provide you with a comprehensive breakdown of the total cost, including our Employer of Record (EOR) fees.

Try our fully loaded cost calculator now and take the first step towards building your world-class team in India: Salary Calculator India: Simplify Your Take-Home Pay Calculation

What taxes should employers and employees be aware of in India?[toc=Taxes in India]

In our extensive experience managing payroll and legal compliance in India, we’ve found that understanding Indian tax regulations is crucial for both foreign employers and local employees. Here’s a concise, up-to-date overview:

Income Tax

Income tax is a direct tax levied by the government on an individual's income. In India, the income tax rates for the financial year 2025-26 are based on a progressive tax system, where the tax rate increases as taxable income rises.

India has two income tax thresholds commonly known as the “Old Tax Regime” and “New Tax Regime” .

Surcharge for New Tax Regime:

- 10% if income exceeds ₹50 lakhs but not ₹1 crore.

- 15% if income exceeds ₹1 crore but not ₹2 crore.

- 25% if income exceeds ₹2 crore.

Additionally:

- Salaried individuals are eligible for a standard deduction of ₹75,000, effectively making incomes up to ₹12.75 lakh tax-free.

- A rebate under Section 87A ensures zero tax liability for taxable incomes up to ₹12 lakh.

Surcharge for Old Tax Regime:

- 10% if income exceeds ₹50 lakhs but not ₹1 crore.

- 15% if income exceeds ₹1 crore but not ₹2 crore.

- 25% if income exceeds ₹2 crore but not ₹5 crore.

- 37% if income exceeds ₹5 crore.

Additionally:

- A 4% Health and Education Cess is applied to the tax amount after adding surcharge in both regimes.

Tax Deducted at Source (TDS)

- Employers must deduct TDS from salaries each month based on the applicable tax slab and remit it to the government.

- TDS applies to salaries, professional fees, and certain allowances.

- Recent threshold updates benefit freelancers and contract workers by raising exemption limits.

Professional Tax

- Levied by state governments; not all states apply it.

- Deducted monthly from employees’ salaries and varies by location and income.

- Example: Maharashtra up to ₹200/month; Tamil Nadu up to ₹1,250/half-year.[Professional Tax Examples]

Provident Fund (EPF)

- Both employer and employee contribute 12% of basic salary.

- Provides retirement benefits; contributions are often tax-exempt up to ₹1.5 lakh/year under Section 80C.

Employee State Insurance (ESI)

- For employees earning ≤₹21,000/month.

- Employer contributes 3.25% and employee 0.75% of gross salary.

- Covers healthcare, maternity, and disability benefits.

Goods and Services Tax (GST)

- Applicable only if the company is providing taxable services and annual turnover exceeds prescribed thresholds (generally not affecting standard employment relationships).

Staying compliant with these taxes and deductions is essential for smooth operations in India. An EOR or specialized payroll provider handles all these requirements managing calculations, filings, remittances, and providing timely updates as regulations evolve.

What are the standard leave policies in India?[toc=Leaves Policies]

India’s labor laws mandate specific leave entitlements to ensure employee welfare and work-life balance. From our extensive experience managing HR compliance in India, here’s a clear summary of the key leave types employers must provide:

- Earned Leave (Annual/Privilege Leave): Employees are typically entitled to 12–15 days of paid leave per year, which can be accrued and carried forward as per organization or state rules.

- Sick Leave: Usually 7–12 days per year, sick leave is provided for health issues and may require a medical certificate for longer absences; policies can vary by company and state.

- Casual Leave: Allotted for short-term personal or emergency needs, casual leave ranges from 7–10 days annually and usually cannot be carried over to the next year.

- Maternity Leave: Female employees are entitled to 26 weeks of paid maternity leave for their first two children (12 weeks for subsequent children), as mandated by the Maternity Benefit Act.

For a deeper dive into leave entitlements, national holidays, laws, and best practices across India, check out our detailed guide: Understanding Leave Policy Laws and Holidays in India.

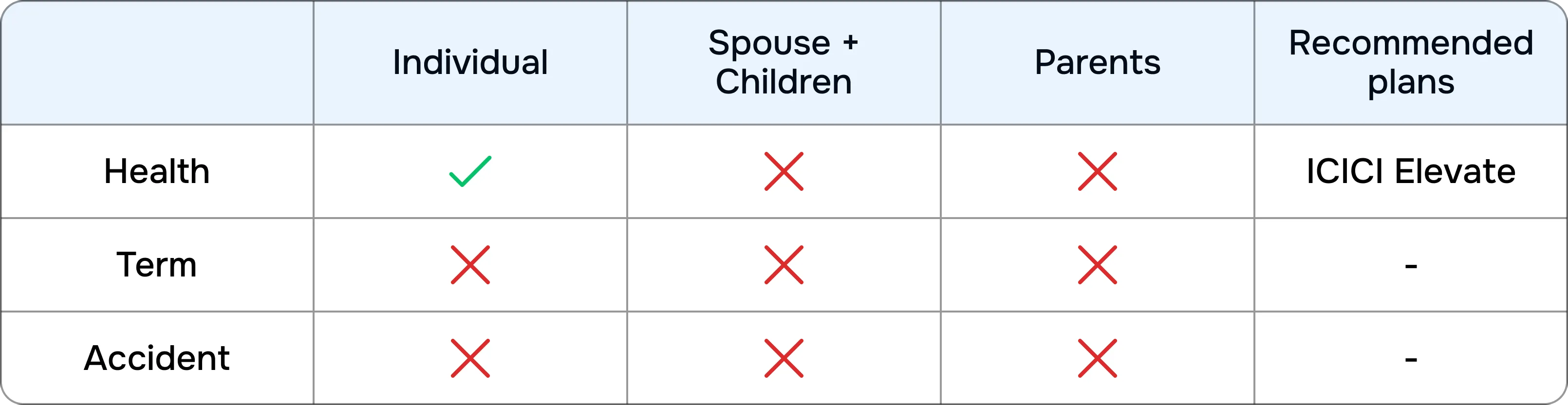

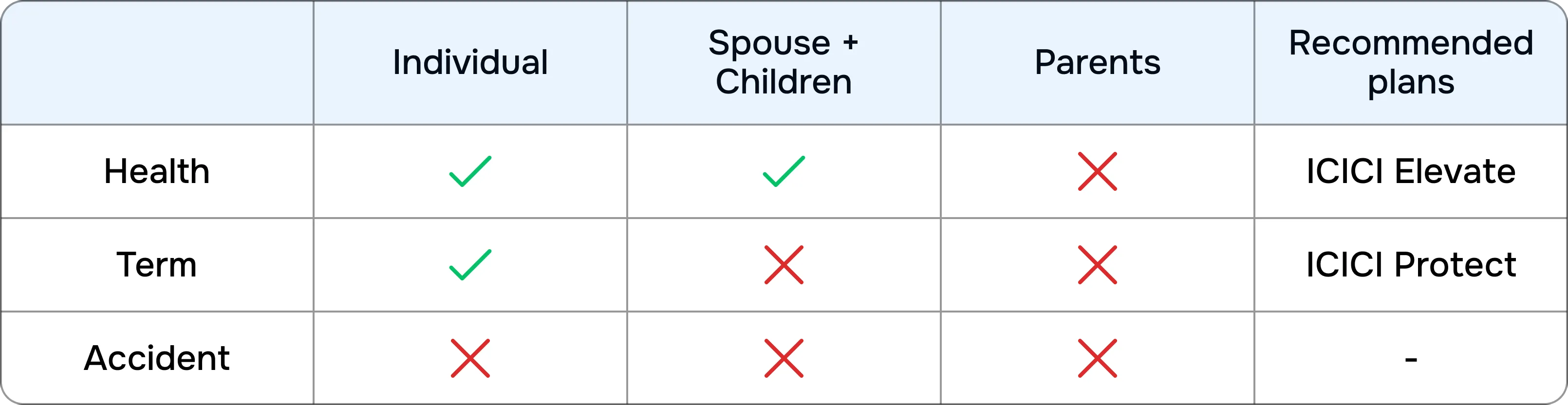

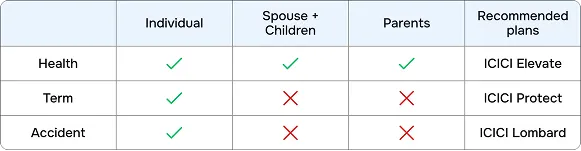

What are the employee benefits in India?[toc=Employee Benefits]

In our experience working with businesses expanding into India, we’ve seen that employee benefits are a critical part of hiring and talent retention. Indian labor law mandates certain statutory benefits for most employees, and many companies also offer additional perks to remain competitive.

1. Statutory Benefits

Statutory benefits in India are legally mandated and include the Employees’ Provident Fund (EPF), Employees’ State Insurance (ESI), gratuity for long service, paid statutory leave, and maternity benefits. These core protections ensure employees have retirement savings, healthcare coverage, and job security during key life events.

2. Supplementary Benefits

Supplementary benefits go beyond legal requirements and often include life or health insurance, performance bonuses, flexible work options, meal or transport allowances, and wellness programs. These extras help companies attract and retain top talent in a competitive market.

If you're looking to dive deeper into how these benefits can impact your talent strategy, check out our Employee Benefits in India: A Comprehensive Guide, it’s a handy resource to help you stay ahead in the competitive talent market.

What are the key steps involved in terminating employees in India?[toc=Termination in India]

Based on our extensive experience managing employee terminations in India, we've identified five key steps for a compliant and smooth process:

- Serve Notice Period: In India, employees with at least one year of service are typically entitled to a 30-90 day notice period. We've found that clearly defining this in the employment agreement helps avoid disputes. Alternatively, employers can offer payment in lieu of notice.

- Follow Due Process for Termination for Cause: When terminating for misconduct or poor performance, it's crucial to follow proper disciplinary procedures. Our legal team advises conducting a thorough investigation, issuing warnings, and providing the employee an opportunity to respond before making a final decision.

- Provide Full and Final Settlement: Upon termination, employers must settle all dues, including outstanding salary, unused leave encashment, and reimbursements. For employees with 5+ years of service, gratuity payment is also mandatory. We've seen that prompt and accurate settlements significantly reduce the risk of legal disputes.

- Issue Necessary Documentation: It's essential to provide a formal termination letter stating the reason and last working day. Additionally, issue a relieving letter and experience certificate. Our clients have found that clear, comprehensive documentation helps maintain professional relationships and minimizes potential conflicts.

- Comply with EOR Responsibilities: For companies using an Employer of Record (EOR), the EOR manages the termination process, ensuring compliance with Indian labor laws. In our experience, this significantly reduces legal risks and administrative burdens for the client company.

What are the various types of terminations in India?

Our HR experts have identified four main types of termination in India:

Note: Larger Companies using EOR services should be aware that terminating a significant number of employees (usually 100 or more) may require additional scrutiny or government notification. This is in accordance with the Industrial Disputes Act, 1947, which mandates government approval for layoffs, retrenchment, or closure in industrial establishments with 100 or more workmen. Pregnant women and those on maternity leave have special protections.

What are the visa and work permit requirements in India?[toc=Visa & Work Permits]

In our experience handling visa and work permit processes for numerous international clients, obtaining the necessary documentation for foreign employees in India can be complex. Here's a comprehensive guide to navigating this process:

Visa Application Process:

- Determine the appropriate visa category (e.g., Employment Visa, Business Visa) based on the purpose of your visit.

- Apply online through the official Indian Visa Online website (https://indianvisaonline.gov.in/visa/). Fill out the application form, upload required documents, and pay the visa fee.

- Schedule an appointment at the nearest Indian Visa Application Center (IVAC) or Indian Mission/Post to submit your physical application, passport, and supporting documents.

- Attend the visa interview, if required, and provide biometric information.

- Track your application status online using the visa enquiry feature on the Indian Visa Online website.

- Collect your passport with the visa stamp from the IVAC or Indian Mission/Post, or receive it by post.

Work Permit (Employment Visa) Requirements:

- Applicant must be a highly skilled professional, employed by a company registered in India.

- Annual salary should be at least US$25,000, with some exceptions for certain professions.

- Visa must be issued from the applicant's country of origin or domicile.

- Applicant must comply with all legal requirements, such as payment of taxes.

- Supporting documents include passport, photos, proof of employment, registration documents of the Indian company, and proof of professional expertise.

Useful Websites:

- Indian Visa Online: https://indianvisaonline.gov.in/visa/

- e-FRRO Portal: https://indianfrro.gov.in/eservices/home.jsp

Our team strongly recommends checking the latest requirements on official websites and consulting with the nearest Indian Embassy, High Commission, or Consulate for up-to-date information.

Need help with Employer of Record in India? Contact us now!

FAQs

What does an EOR company do?

An Employer of Record (EOR) handles all legal employment responsibilities for businesses, including payroll management, employee benefits, and ensuring compliance with Indian labor laws. It acts as the legal employer, managing contracts and statutory obligations on behalf of the client.

Which is the best Employer of Record service in India?

The best EOR services in India include Wisemonk, Deel, and Rippling, which offer comprehensive employee management, local expertise, and compliance with Indian employment laws, ensuring smooth hiring and onboarding processes for global companies.

What is the cost of EOR in India?

The cost of EOR in India typically ranges from $99 to $499 per employee per month, depending on the provider and the services offered, including payroll processing, tax compliance, and benefits administration.

Is Employer of Record legal in India?

Yes, using an EOR in India is fully legal. EORs ensure compliance with Indian labor laws and handle employment contracts, tax filings, and statutory benefits, mitigating legal risks for foreign businesses.

What is the future of EOR in India?

The future of EOR in India looks promising, with more global companies seeking compliant, cost-effective solutions for remote teams. The growing demand for international hiring and labor law compliance will drive the expansion of EOR services across India.

What are the problems with Employer of Record (EOR)?

The main challenges with an EOR include limited control over employees, potential hidden costs, and dependence on the EOR for compliance. If the EOR mishandles labor law compliance, it can lead to legal disputes for the client company.

.webp)

.webp)