- PEOs become the legal employer of your India team through co-employment. They handle payroll processing, statutory compliance (PF, ESI, gratuity, professional tax), tax filing, and employment contracts while you manage daily work.

- PEOs let you hire in India within days without establishing a local entity. Setting up your own company takes 4-6 months and requires navigating complex labor laws across national and state levels.

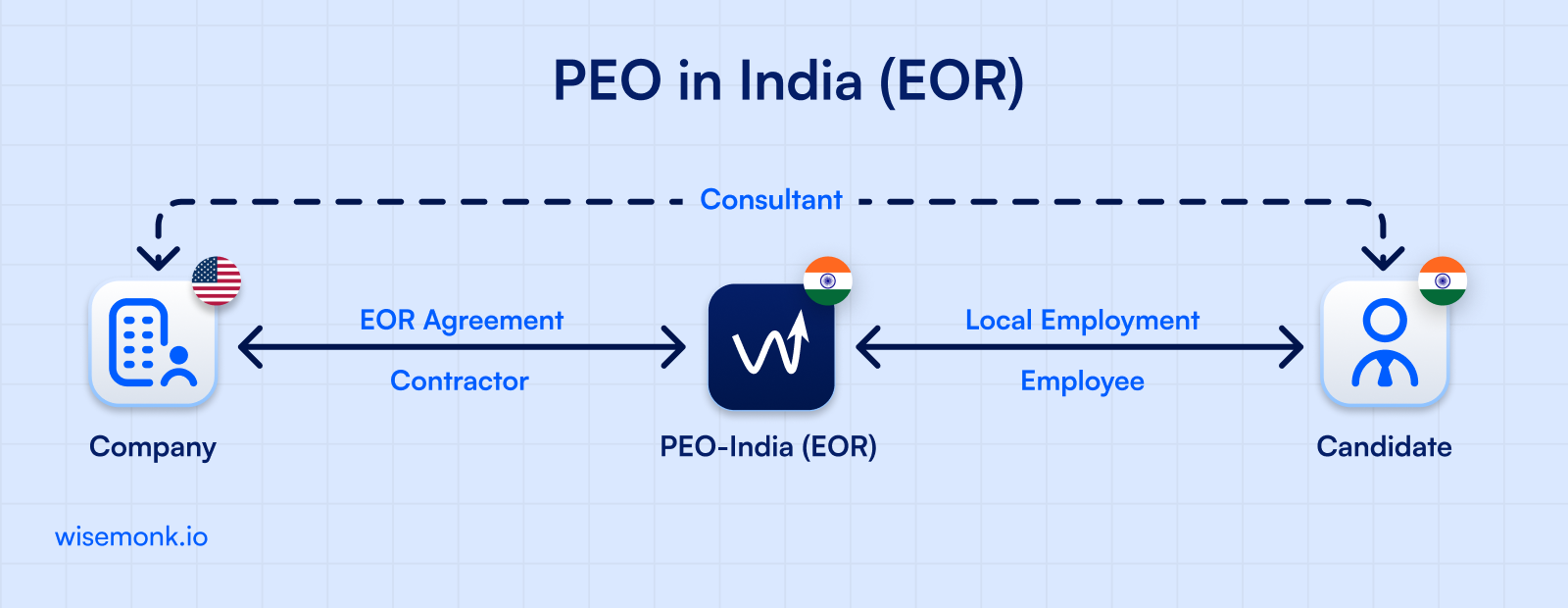

- PEOs require some business presence and share employer responsibilities with you. EORs require zero local presence and take full legal employer liability. Both handle payroll, compliance, and HR functions.

- PEOs protect you from compliance violations, statutory filing penalties, and tax deduction errors. You remain liable for workplace management decisions, wrongful termination claims, and employee treatment issues.

- Operating without a PEO means illegal employment practices in India. Penalties range from ₹5,000 to ₹1,00,000+, potential criminal prosecution for serious violations, back taxes on PF/ESI contributions, and employee lawsuits for unpaid benefits.

Need help with PEO services in India? Reach out to us today!

Discover how Wisemonk creates impactful and reliable content

Want to hire employees in India but don't want to spend months setting up a legal entity?

A Professional Employer Organization (PEO) might be your answer, but only if you understand how it actually works and whether it's the right fit for your business.

Most global companies get confused between PEOs and EORs, underestimate India's compliance complexity, or end up with unexpected costs because they didn't ask the right questions upfront.

This guide cuts through the confusion. You'll learn exactly how a PEO in India operates, what they handle (payroll management, statutory benefits, Indian labor laws compliance), how much they actually cost, and most importantly, whether you even need one or if an employer of record makes more sense for your situation.

By the end, you'll know if a PEO service provider is the right partner for building your team in India, or if you should take a different route entirely.

What is a PEO and how does it work in India?[toc=What is PEO in India]

A Professional Employer Organization (PEO) is basically your HR outsourcing partner that becomes the legal employer of your Indian team. You still manage the employees and their work, but the India PEO handles everything related to payroll, compliance, and employment practices.

Here's the simple version: You find and hire the talent. The PEO service provider puts them on their payroll. They handle contracts, pay employees, manage statutory benefits like Provident Fund and ESI, and keep you compliant with Indian labor laws. Your team works for you, but legally, the PEO is their employer. That's the co-employment model in action.

Why do you need a PEO in India?

Because setting up your own company in India takes 4-6 months, costs a lot, and requires navigating complex legal requirements. An India PEO lets you start hiring in days without establishing a local entity.

Plus, Indian employment law is complicated. Between Provident Fund, Employee State Insurance, gratuity, professional tax, and state-level regulations, there's a lot to mess up. A PEO service ensures you don't.

What specific services does a PEO provide in India?

Think of them as your complete HR management solution on the ground:

- Payroll processing and payroll taxes

- Statutory compliance (PF, ESI, professional tax, labor law filings)

- Top tier employee benefits and benefits administration

- Employment contracts and HR documentation

- Tax filing and deductions

- Work permits for international employees

- Ongoing regulatory compliance and risk management

What makes PEO services different from traditional hiring models in India?

Traditional hiring means you need a local business entity. That's registering a subsidiary, maintaining legal compliance, setting up bank accounts, hiring HR staff, and dealing with local laws yourself.

Indian PEOs skip all that. No local entity required. No branch office. No need to become an expert in employment law. The co-employment relationship means they handle employer responsibilities while you focus on core business.

This is perfect when you're testing new markets, hiring a small team, or want to avoid the time and hidden fees of setting up your own entity.

How does a PEO streamline employee management for foreign companies?

If you're a global company managing employees across multiple countries, you know it's messy. Different payroll systems, different HR processes, different compliance calendars.

An Indian PEO consolidates all that for your India operations. One point of contact handles the hiring process, ensures employees onboarded meet legal requirements, processes payroll management, and administers competitive benefits. You're not juggling HR functions across borders or worrying about whether you're following local employment laws correctly.

You get to focus on building your global workforce and growing your core business. Your team gets professional HR support and key benefits. And you avoid the legal compliance headaches that come with managing human resources in a new country.

What's the difference between a PEO and an EOR in India?[toc=PEO vs. EOR]

Here's the main difference:

- A Professional Employer Organization (PEO) operates on a co-employment model where you share employer responsibilities.

- An Employer of Record (EOR) becomes the full legal employer and takes complete responsibility for your employees.

With a PEO in India, you typically need some form of business presence (even if it's just a registered entity). With an EOR, you need absolutely nothing. Zero local entity, zero paperwork, zero setup.

Both handle payroll management, statutory benefits, compliance with Indian labor laws, and HR functions. The difference is who holds the legal liability and how much control you maintain over employment practices.

Which should you choose?

- If you have zero presence in India and want to hire employees fast without setting up your own company, an EOR is your answer.

- If you already have a local business entity or plan to establish one, a PEO might be more cost-effective since you're sharing employer responsibilities.

For most global companies testing new markets or hiring small teams, an EOR is simpler - no legal entity required, no compliance headaches, and you can focus on core business activities.

Want a detailed breakdown? We've written a comprehensive guide comparing PEO vs EOR in India, including costs, legal implications, and which model fits different business scenarios.

How does a PEO in India handle payroll, taxes, and compliance?[toc=Payroll & Compliances]

A PEO service provider takes complete ownership of your payroll processing, tax filing, and compliance with Indian labor laws. They calculate salaries, deduct taxes, process payments, and file everything with the government. You don't touch any of it.

Here's what they manage:

- employee income tax (TDS)

- Provident Fund (PF) contributions

- Employee State Insurance (ESI)

- professional tax

- labor welfare fund

And any other payroll taxes mandated by Indian employment law. They also handle salary transfers to employee bank accounts on time, every time.

How does a PEO ensure compliance with Indian labor laws and tax regulations?

Good PEO service providers have dedicated compliance teams tracking local employment laws across all Indian states.

Because here's the thing: labor laws in India aren't just national. States have their own rules for professional tax, shops and establishments acts, and other regulations.

Your PEO monitors these laws, updates their payroll management systems when rules change, and ensures every payment and filing meets legal compliance requirements. They handle registrations for PF, ESI, and other statutory benefits, maintain records, and file returns on schedule.

They also manage compliance calendars so nothing gets missed. Monthly PF deposits, quarterly ESI returns, annual tax filings, and other regulatory compliance deadlines all get handled automatically.

Does the PEO in India handle all payroll taxes?

Yes, everything. When they pay employees, they automatically calculate and deduct:

- Income tax (TDS) based on the employee's salary and tax bracket

- Employee's share of Provident Fund (12% of basic salary)

- Employee's share of ESI (if applicable, 0.75% of gross salary)

- Professional tax (varies by state)

The PEO also pays the employer's contributions (12% PF, 3.25% ESI, and any other mandatory deductions). They file these with the government and provide you with proof of compliance.

What are the reporting requirements when working with a PEO in India?

From your side? Minimal. You approve payroll, provide any changes (new hires, terminations, salary adjustments), and that's mostly it.

The PEO handles all government reporting. They file monthly PF returns, ESI challans, TDS returns, annual PF statements, Form 16 for employees, and maintain compliance documentation. You get regular reports showing what was paid, what was filed, and confirmation that everything's compliant.

Most India PEO services give you a dashboard where you can see payroll status, tax filings, and compliance reports anytime.

How does the PEO handle changes in tax laws or employee benefits in India?

India changes tax rules and employment law fairly often. New budget announcements, updated labor codes, revised tax slabs. It happens.

Your PEO service provider tracks these changes and implements them immediately. When tax deductions change, they update their payroll processing system. When new statutory benefits become mandatory, they add them. When filing formats change, they adapt.

You don't need to monitor government websites or worry about missing updates. The PEO's compliance and risk management team does that. They notify you of changes that might affect costs (like increased employer contributions), but they handle the implementation and administrative tasks.

This is one of the key benefits of using a PEO. You're not constantly trying to keep up with regulatory compliance changes in a country where laws evolve frequently.

What are the legal responsibilities and liabilities of using a PEO in India?[toc=Legal Responsibilities & Liabilities]

When you use a PEO in India, they share legal liability with you under the co-employment relationship. They're responsible for employment law compliance, statutory filings, and meeting employer responsibilities. You're responsible for workplace management and day-to-day employee issues.

Think of it this way: the PEO owns the legal compliance side, you own the work management side.

What legal protections does a PEO offer to my company in India?

A PEO service provider protects you from compliance violations. If labor department inspections happen, missing filings surface, or statutory benefit disputes arise, the PEO handles it because they're the legal employer managing those processes.

They also shield you from penalties related to incorrect tax deductions, late filings, or improper documentation. Since they're processing payroll and managing regulatory compliance, they own those risks.

However, understand this: if you discriminate against an employee, violate workplace safety, or create hostile work conditions, that's on you. The PEO protects you from administrative and compliance risks, not from how you treat people.

Does a PEO shield my business from potential legal risks when hiring in India?

Partially, yes. The PEO takes on risks related to employment practices, payroll taxes, benefits administration, and legal compliance with Indian labor laws. If something goes wrong with statutory payments or government filings, they're liable.

But under the co-employment model, you still share some exposure. Wrongful termination claims, workplace disputes, or violations of local laws that stem from your management decisions can still land on you.

The risk management advantage is real though. Most global companies don't have thorough understanding of Indian employment law. One missed filing or incorrect gratuity calculation can trigger penalties. The PEO prevents those mistakes.

How does a PEO handle statutory benefits like PF, ESI, gratuity, and other mandatory benefits in India?

Gratuity is the big one we haven't covered yet. In India, employees who complete five years get gratuity (about 15 days of salary per year worked). The PEO calculates this, sets aside provisions, and pays it when employees leave.

They also manage other mandatory benefits beyond what we've discussed: maternity leave (26 weeks paid), bonus payments for eligible employees, leave encashment, and notice period calculations during terminations.

Your PEO maintains records proving all these benefits were provided correctly. If an employee disputes their gratuity amount or claims unpaid benefits, the PEO has the documentation and handles the resolution.

What is the process of handling legal disputes or employee issues through a PEO?

If an employee files a labor court case or raises a legal dispute, your PEO service provider steps in as the legal employer. They coordinate with labor lawyers, attend hearings, manage documentation, and represent the employer side.

For employee grievances that aren't legal disputes yet (salary issues, benefit questions, documentation problems), the PEO's HR support team handles resolution. They mediate, provide clarifications, and fix administrative errors.

If you need to terminate someone, the PEO ensures it's done legally. They calculate final settlements, ensure proper notice periods, handle gratuity payments, and provide all required documentation. This protects you from wrongful termination claims that come from procedural mistakes.

The key benefit here is that PEOs deal with Indian labor courts and employment practices daily. You get their experience navigating a legal system that favors employees heavily. That's valuable when you're a foreign company unfamiliar with how disputes actually play out in India.

How does a PEO in India support employee onboarding and HR operations?[toc=Onboarding & HR Operations]

A PEO in India handles your entire employee onboarding process from offer letter to first paycheck. They create employment contracts, collect documentation, set up payroll records, process background verifications, and ensure new hires have everything they need before day one.

You focus on getting your team productive. They handle the paperwork.

What is the onboarding process like when working with a PEO in India?

Once you decide to hire someone, you tell your PEO service provider. They take it from there.

They draft the employment contract based on Indian employment law, send the offer letter, collect documents (PAN card, Aadhar, bank details, education certificates), run background checks if needed, and create the employee's payroll profile.

For international employees, they coordinate work permits and visa documentation. For local hires, they ensure all statutory registrations (PF number, ESI number, professional tax) are completed.

Most India PEO services get someone fully onboarded in 3 to 5 days (Wisemonk enables onboarding to be completed in as little as 1 to 2 days). Your new hire shows up ready to work with contracts signed, bank setup done, and benefits activated.

How does a PEO ensure smooth integration of new hires into the company?

The PEO handles the administrative tasks so new employees aren't stuck filling forms during their first week. They provide welcome kits with company policies, benefits information, and leave policies. They explain how payroll works, when salaries get paid, and who to contact for HR questions.

For your successful team building, this matters because new hires can focus on learning their role instead of navigating HR processes. The PEO's HR support team becomes their go-to for benefits questions, documentation issues, or policy clarifications.

Can the PEO handle employee contracts, documentation, and other administrative tasks?

Yes, completely. Every employment contract needs to comply with local laws, include mandatory clauses about notice periods and gratuity, and specify statutory benefits clearly. Your PEO drafts these correctly.

They also manage ongoing documentation throughout the employee lifecycle. Salary revisions get new appointment letters. Promotions get updated contracts. Role changes get proper documentation. When someone leaves, the PEO prepares resignation acceptance, full and final settlement letters, and experience certificates.

This removes a massive administrative burden from your core business. You're not maintaining HR files, tracking document renewals, or worrying whether your contracts meet legal requirements.

How does a PEO support employee engagement and retention in India?

This is where PEO services vary significantly. Basic providers just process payroll. Good ones actively support your retention efforts.

Top tier PEOs offer competitive benefits packages that help you attract top talent. They provide insights on market salary benchmarks, suggest benefits that employees actually value, and help structure compensation to retain your best people.

They also handle performance management documentation, manage employee grievances professionally, and provide HR consulting on local employment practices. If you're wondering why someone resigned or how to improve retention, experienced PEO providers share what works in the Indian market.

Some India PEO services like Wismeonk even support employee engagement initiatives, help structure recognition programs, and advise on creating positive remote team cultures that work within Indian workplace norms.

The HR functions they provide go beyond just compliance. They become your partner in building a team that stays and performs well.

How do PEOs in India handle recruitment and hiring processes for global companies?[toc=Recruitment & Hiring]

Most PEO service providers in India don't actually recruit for you. Their core business is payroll management, compliance, and HR functions for employees you've already hired. Recruitment is typically separate.

That said, some full-service providers bundle talent acquisition with their PEO services. They'll help you find local talent, screen candidates, conduct interviews, and manage the entire hiring process from job posting to offer acceptance.

Can a PEO assist in finding local talent in India?

It depends on the provider. Traditional PEOs focus on employment practices and compliance once you've made a hire. You find the talent, they employ them.

But if you're a global company without local hiring expertise, some providers offer recruitment support. At Wisemonk, for example, we help companies hire employees in India even if they have zero local presence. We've supported 300+ global companies in building teams across India, so we understand what top talent looks like in different roles and industries.

The advantage of working with a provider that offers both recruitment and employer of record services is simple: one partner handles finding the person and employing them. You're not coordinating between a recruitment agency and a separate PEO service provider.

Does a PEO help with the recruitment process, including background checks and contract management?

Background verification is standard. Most India PEO services verify employment history, education credentials, criminal records, and reference checks before finalizing hires. This protects you from bad hires and ensures people are who they claim to be.

Contract management absolutely gets handled. The PEO drafts employment contracts that comply with Indian labor laws, include all mandatory clauses, and specify statutory benefits correctly. They manage offer letters, appointment letters, and all hiring documentation.

For the actual recruitment (sourcing, screening, interviewing), you'll need to check what your provider offers. Some handle it, many don't.

How can a PEO ensure that my hiring process is compliant with Indian labor laws?

Every employment contract needs specific clauses about notice periods, gratuity eligibility, probation terms, and termination conditions. A good PEO ensures these are included and legally sound.

They also verify that job offers meet minimum wage requirements, include mandatory benefits, and don't violate any labor regulations. For certain roles, there are restrictions on working hours, overtime rules, and industry-specific employment law requirements. Your PEO flags these before you make an offer.

Background checks are another compliance layer. Verifying candidates protects you from legal issues down the line.

What types of roles and industries do PEOs in India specialize in?

Most PEOs work across industries. Technology, finance, marketing, operations, customer support, whatever you need. The employment practices and payroll processing don't change dramatically between sectors.

That said, providers with deep market experience understand industry-specific hiring challenges. Tech companies need different talent acquisition strategies than manufacturing firms. Remote team structures differ from office-based setups.

At Wisemonk, we work with companies hiring across roles, from software engineers to finance teams to sales operations. We've onboarded 2,000+ employees across India and manage over $20 million in payroll, so we've seen what works for different business operations and team structures.

The key is finding a provider who understands your specific needs. If you're hiring top tier talent in specialized roles, you want a partner with experience in your industry and access to the right talent pools.

What are the risks of not using a PEO in India?[toc=Risks of Not Using PEO]

If you hire employees in India without a PEO or local entity, you're operating illegally. Plain and simple. You can't just pay someone in India as if they're a contractor when they're actually an employee. That's misclassification, and Indian authorities take it seriously.

What are the legal consequences of failing to comply with Indian employment laws?

Penalties for non-compliance with Indian labor laws aren't small fines. You're looking at:

- Back taxes plus interest on unpaid Provident Fund and ESI contributions

- Penalties ranging from ₹5,000 to ₹1,00,000+ depending on the violation

- Criminal prosecution for serious violations (yes, jail time is possible for company directors)

- Employee lawsuits for unpaid statutory benefits, gratuity, or wrongful termination

- Being blacklisted from future business operations in India

Labor courts in India heavily favor employees. If you've been operating without proper compliance and an employee files a case, you'll lose. And the settlements can be significant.

How could my business be exposed to liabilities without a PEO in India?

Without proper legal compliance, every employee becomes a liability. If someone claims unpaid Provident Fund, miscalculated gratuity, or missing benefits, you're exposed. And they can file claims going back years.

There's also contractor risks. Many companies try to avoid PEO costs by classifying employees as contractors. Indian tax authorities are cracking down hard on this. If they determine your "contractor" is actually an employee, you owe all back taxes, penalties, and interest. Plus, the contractor can sue for employee benefits they should have received.

You're also exposed if you don't have proper work permits for international employees or if your employment contracts don't meet legal requirements.

What risks should I be aware of if I handle payroll and HR compliance in-house without a PEO?

Even if you set up your own entity, managing HR functions in-house is risky if you don't have thorough understanding of Indian employment law.

Missing filing deadlines, calculating taxes incorrectly, not updating for regulatory compliance changes, improper termination procedures, these mistakes happen constantly when foreign companies try to manage their own payroll processing and compliance.

Each mistake triggers penalties. Multiple violations can shut down your business operations in India or prevent you from expanding to new markets.

A PEO service provider eliminates these risks. They own the compliance, handle the administrative tasks, and ensure you're operating legally. For global companies focused on core business activities, that peace of mind is worth it.

Get Started with Wisemonk EOR[toc=Wisemonk EOR]

Ready to hire in India without the hassle of setting up a local entity? Wisemonk makes it simple.

We've helped 300+ global companies build teams across India, managing over $20 million in payroll for 2,000+ employees. Whether you're hiring your first employee or scaling a remote team, we handle everything: compliance with Indian labor laws, payroll processing, statutory benefits, HR support, and even recruitment if you need it.

No setup fees. No hidden costs. No legal complexity. Just fast, compliant hiring that lets you focus on growing your business operations while we handle the administrative tasks.

Our team understands what global companies need because we work with businesses from the US, UK, Europe, and Australia every day. We know the compliance challenges, the payroll quirks, and how to make international expansion in India actually work.

Start hiring in India in days, not months. Schedule a free consultation with Wisemonk

Frequently asked questions

Which company provides PEO services in India?

Several global companies providers offer PEO services, including Wisemonk, Deel, Rippling, Papaya Global, and Remote. Wisemonk stands out as an India-specialized PEO and Employer of Record (EOR) partner that helps international companies manage payroll, HR, and compliance seamlessly across India’s diverse labor landscape.

What are the three types of PEO?

The three primary PEO models are Traditional, Transactional, and Strategic. A Traditional PEO focuses on standard HR functions like payroll and basic benefits, making it ideal for companies with slower growth. A Transactional PEO is a software-centric model designed for businesses that have internal HR expertise but need a platform to automate tasks. Finally, a Strategic PEO acts as a high-touch growth partner, offering personalized support, specialized guidance on indian labor laws, and equity strategy advice to help you scale rapidly in new markets.

How much do PEO services cost in India?

The cost of PEO services in India generally depends on the number of employees and the complexity of the hr functions required. Most providers use a flat monthly fee ranging from $99 to $250 per employee, or a percentage-based model that typically charges between 3% and 12% of the total monthly payroll. These fees cover the administration of local payroll, tax deductions, and benefits administration, but do not include the actual cost of statutory benefits like the provident fund.

What are the three types of PEO?

The three main types of PEOs are:

- Comprehensive PEO: Handles all HR functions, including payroll, benefits, and compliance.

- Co-Employment PEO:Shares employer responsibilities with your company while managing compliance and HR tasks.

- EOR (Employer of Record) PE: Acts as the full legal employer for employees, allowing you to hire without a local entity.

What is the difference between a BPO and a PEO?

The main difference between a BPO (Business Process Outsourcing) and a PEO is the legal relationship and the level of liability. In a BPO arrangement, you remain the sole legal employer and retain 100% of the risk while outsourcing specific tasks like payroll management to an external vendor. In contrast, a PEO uses a co employment model where they become the employer of record for tax and legal purposes, sharing the employer responsibilities and helping you navigate complex employment practices with shared liability.