- India’s 2025 minimum wage levels involve a national floor wage of ₹178/day with typical earnings converting to roughly $2.12–$2.47 per day at an exchange rate of ₹83.5 per USD, aligning to about $65–$80 per month.

- Minimum wage in India varies by state and skill level, ranging from $9.14-$12.08 per day under central rates, with states like Delhi setting higher rates ($215.45/month for unskilled workers) based on local economic conditions.

- Minimum wage calculation in India is based on combining a base wage with Variable Dearness Allowance while classifying workers as unskilled, semi-skilled, skilled, or highly skilled and rates shift further by urban or rural location and by industry.

- Non-compliance with India’s minimum wage laws can lead to fines reaching the USD-equivalent of ~$500+ and mandatory back-wage payoutsand it can also include the possibility of imprisonment for up to three months under enforcement provisions.

Need help navigating India’s minimum wage and compliance rules? Connect with our experts today.

Discover how Wisemonk creates impactful and reliable content.

Navigating minimum wages in India can be confusing, with frequent changes and wide variations across states and industries. Many employers worry about compliance, while workers often aren’t sure if they’re getting fair pay.

In this article, we break down the latest minimum wage rates, how they’re set, and what you need to know for 2025. Whether you’re an employer or employee, you’ll find practical, up-to-date answers here.

What is the minimum wage in India?[toc=Introduction]

The minimum wage in India is the legally mandated lowest pay employers must offer, varying by state and skill level due to diverse economic conditions. Established under the Minimum Wages Act of 1948, it safeguards workers from exploitation and ensures a basic standard of living. Based on our experience with global companies, compliance is crucial for fair labor practices and avoiding penalties.

For reference: A helpful conversion benchmark is roughly ₹83 = $1 USD.

How is the minimum wage calculated in India?[toc=Minimum Wage Calculation]

In our experience working with employers across India, we’ve found that minimum wage calculation is a systematic process that balances legal requirements and economic realities. The government sets these wages to ensure workers receive fair pay that reflects both their role and the local cost of living.

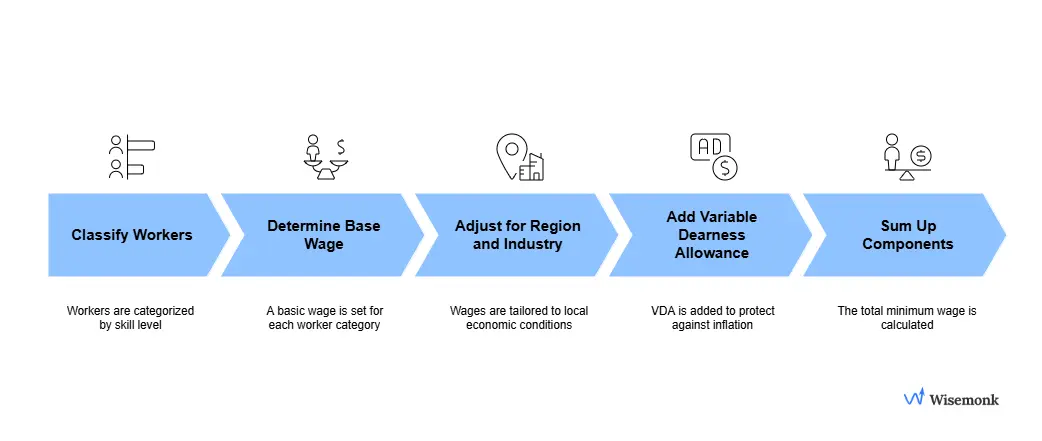

Here’s how the calculation typically works:

- Classification of Workers: Workers are categorized as unskilled, semi-skilled, skilled, or highly skilled. Each category has a different minimum wage, with higher skills earning higher rates.

- Determining the Base Wage: The government sets a basic wage for each worker category, which acts as the foundation for the minimum wage.

- Adjusting for Region and Industry: Minimum wages are further tailored based on whether the job is in an urban or rural area and the specific industry (like construction, textiles, or agriculture). This ensures the wage reflects local economic conditions and sector standards.

- Adding Variable Dearness Allowance (VDA): To protect workers from inflation, the Variable Dearness Allowance is added to the base wage. The VDA is revised periodically based on the Consumer Price Index (CPI), so wages keep pace with rising living costs.

- Summing Up the Components: The total minimum wage is the sum of the base wage and allowances (mainly VDA, and sometimes other statutory allowances like HRA if applicable).

Example the way global employers understand it

A US-based SaaS company hiring a semi-skilled back-office employee in Hyderabad would see the calculation play out like this:

- Base wage (semi-skilled, urban): ₹500/day (~$6.00/day)

- VDA adjustment: ₹100/day (~$1.20/day)

So the final minimum wage comes to ₹600/day (~$7.20/day), and this applies whether the employee works remotely or onsite within the same wage zone.

What is the current minimum wage in India?[toc=Current Minimum Wage]

Based on our extensive research and recent state notifications, the minimum wage in India for 2025 continues to reflect significant regional and skill-based differences. The lowest minimum wage is ₹783 ($9.14) per day for unskilled workers, while the highest reaches up to ₹1,035 ($12.08) per day for highly skilled workers, as set by the Central Government. However, actual rates can vary depending on the state government, with some states setting higher minimum wages based on local economic conditions.

- Central Government monthly minimum wage rates:

- Unskilled: ₹20,358 (₹783/day)

- Skilled: ₹24,804 (₹954/day)

- Highly skilled: Up to ₹1,035/day

- State variations: Many states have announced fresh wage notifications for 2025, so rates can differ widely depending on location, industry, and even the specific skill category. For example, states like Delhi, Maharashtra, and Karnataka often set higher minimum wages than the central rates, reflecting local living costs and economic priorities.

Having guided several global companies through compliance, we can say that staying updated with both central and state wage notifications is essential for legal and operational certainty in India.

What are the latest state-wise minimum wage rates in 2025?[toc=State-Wise Minimum Wage]

If you place two employees with the same job title in two different Indian states, their minimum wages might differ by more than 40%. This isn’t a glitch, it’s how India’s wage system is designed. Each state sets its own wage floors depending on local industry density, cost of living, and political priorities.

From our experience guiding US, UK, and EU employers through multi-state hiring in India, here are the state-wise India minimum wages roughly listed:

Why does India not have a single national minimum wage?[toc=No National Minimum Wage]

In our experience assisting businesses across India, we’ve found that the absence of a single national minimum wage is rooted in the country’s vast economic and social diversity. India’s federal structure empowers both central and state governments to set minimum wages, allowing for flexibility to address local cost-of-living differences and industry needs.

Key reasons for this approach:

- Diverse Economic Conditions: States vary widely in terms of living costs, industrial development, and skilled labor market conditions.

- Legal Framework: The Minimum Wages Act, 1948, and the Code on Wages, 2019, place wage-setting authority with both central and state governments.

- Sector and Region Specificity: Minimum wages are tailored for different sectors, skill levels, and even urban versus rural areas within states.

Based on our extensive research, this decentralized system helps ensure that wage standards remain relevant and fair across India’s many regions and industries.

What are the penalties for not paying minimum wage in India?[toc=Penalties]

Based on our extensive research and direct experience with labor compliance, we can confirm that not paying the mandated minimum wage in India can lead to serious legal consequences for employers. The government has established strict penalties to ensure that industrial workers receive their rightful wages.

Key penalties for non-compliance:

- Fines: Employers can face fines up to ₹50,000 ($583.70) for failing to pay minimum wages.

- Imprisonment: In cases of repeated violations, imprisonment for up to three months may be imposed.

- Back Wages: Employers are required to pay the difference between the wages paid and the minimum wage, along with possible compensation.

- Legal Proceedings: Workers can file complaints with labor authorities, and cases may be taken to labor courts for resolution.

In our experience, prompt compliance with minimum wage laws not only avoids these penalties but also helps maintain a positive workplace reputation and employee trust.

What are the latest changes in minimum wage laws for 2025?[toc=Latest Changes]

Based on our extensive research and review of official updates, 2025 has brought significant changes to minimum wage laws across India. Several states have revised their minimum wage rates, reflecting rising living costs and economic conditions.

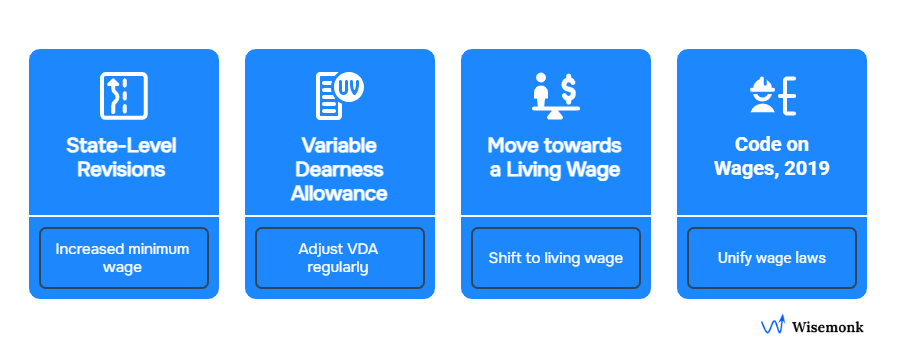

- State-level revisions: Delhi increased its minimum wage to ₹18,456 ($215.45) for unskilled workers and ₹24,356 ($284.31) for graduates and above, effective April 1, 2025. States like Punjab, Goa, Andhra Pradesh, Bihar, and Karnataka have also issued fresh wage notifications for 2025.

- Variable Dearness Allowance (VDA): The central government continues to adjust VDA regularly based on the Consumer Price Index to protect wages from inflation.

- Move towards a Living Wage: Policy discussions are underway to shift from the minimum wage system to a living wage framework, which would consider essential living costs such as housing, food, healthcare, and education.

- Code on Wages, 2019: This legislation aims to unify wage laws and is expected to play a key role in future wage reforms.

Having guided multiple global companies through these changes, we emphasize the importance of monitoring both central and state notifications to ensure compliance and fair compensation in 2025.

How India’s new labour codes affect minimum wage in 2025?[toc=Impact of Labour Codes]

India officially rolled out all four new Labour Codes as of November 21, 2025, including the Code on Wages, 2019, which finally gives every worker in the country a statutory right to minimum wage. From our experience helping global companies manage payroll in India, this is one of the most important regulatory shifts employers should understand.

Key changes that impact minimum wage in 2025

Here’s what global employers need to know:

- Universal coverage: Minimum wage rules now apply to all workers, not just those in “scheduled” industries. This significantly expands protection and compliance scope.

- National Floor Wage: The central government must now set a national floor wage , and states cannot legally go below it. Individual states will still publish their own rates above that floor.

- Uniform wage definition (50% rule): “Wages” now have a standardized definition across India. Basic salary must form at least 50% of total CTC, which increases social security contributions (PF, gratuity) and makes payroll more transparent.

For some companies, this may reduce take-home pay but strengthens long-term benefits. - Timely wage payment: Employers are now legally required to pay all workers on time, not just those under certain categories.

- State-specific VDA revisions continue: Even with a central wage framework, states still revise their Variable Dearness Allowance (VDA) based on local inflation. For example, Odisha, Goa, Jharkhand, and Andhra Pradesh issued new VDA notifications effective October 1, 2025.

As India’s wage reforms take shape, the smartest move for employers is to stay updated and adjust payroll structures early rather than react when compliance issues surface.

Where can you find official minimum wage updates and notifications?[toc=Get Updates & Notifications]

In our experience, the most accurate and up-to-date information on minimum wage rates and government regulation in India comes from official government sources. Both central and state authorities regularly publish notifications and revisions online.

Trusted sources for official updates:

- Chief Labour Commissioner (Central) Website:

Find central government minimum wage notifications, Variable Dearness Allowance (VDA) orders, and scheduled employment rates. [clc.gov.in/clc/] - Ministry of Labour & Employment:

Access central wage laws, rules, and policy updates. [labour.gov.in] - Minimum Wages Act, 1948 (Full Text):

Review the foundational law and its provisions for wage fixation and revision. [clc.gov.in/acts-rules/minimum-wages-act] - State Labour Department Notifications:

Each state publishes its own wage notifications and revisions. For a consolidated view of recent updates across states, refer to: [comply4hr.com/minimum-wages.asp]

For the most reliable compliance, always consult these official portals for the latest notifications and amendments.

How can Wisemonk help?[toc=How Wisemonk helps]

Wisemonk is a leading Employer of Record (EOR) service in India dedicated to helping global companies hire, pay, and manage talent in India without the need for a local entity. With our deep expertise in Indian labor laws and payroll compliance, we make it simple for businesses to stay fully compliant with minimum wage regulations in every state, ensuring your workforce is always paid accurately and on time.

Key features we offer for minimum wage compliance:

- Automated payroll management that always reflects the latest state-wise minimum wage updates.

- Multi-state compliance expertise, so you never miss a regulatory change, no matter where your team is based.

- Statutory contributions handled end-to-end (EPF, ESI, gratuity, professional tax, etc.).

- Transparent, audit-ready record-keeping for all wage and compliance documentation.

While India remains our strongest capability, we’re steadily expanding into major global markets like the US and the UK. With Wisemonk, you get a partner who can support your India operations while helping you scale hiring and payroll across multiple countries.

Ready to simplify payroll in India ensuring full compliance? Reach out to us today and let us handle the complexity, so you can focus on growing your business!

%20Companies%202026.webp)

.webp)

.png)